Archived Post: Ask a Husband #1: Joint Finances

/So back when I first started this website, I did a few installments of this thing where I took some general relationship questions that people sent me and wrote a post in a mock Dear Abby sort of advice column. The few of them I did ranged in how serious the advice I gave was. This one despite being largely about cat sweaters and discontinued cereal (you'll see) I felt actually addressed the question that was posed. Others were far less helpful.

I eventually stopped these as I didn't really enjoy doing them. I took that part of the site down and it's been buried ever since. I came across the posts while digging through some old stuff though and remembered I did actually think some of them were kind of funny, so I decided to re-post them on the main site. I'll put them up one at a time over the next few weeks, and possibly even post one that never saw the light of day in the first place. We'll see.

Here is the first ever Ask a Husband. Perhaps 'Ask an Idiot' would be a more apt title now.

Ask A Husband #1: Joint Finances

Originally posted July 19 2015

For the first ever installment of Ask a Husband, I'm going to discuss a question that I got a few times. That topic is "Joint Finances"

“A newlyweds guide to managing finances together.”

— Paula S.

“How to make his and her money “our” money while both still being able to spend as wanted!”

— Ashley M.

One of the big things that must be dealt with as a newly married couple is figuring out how to make the transition from maintaining separate bank accounts to managing your finances as a joint entity.

Before I begin dishing out advice on this topic, let me start with a disclaimer. On this matter, there really is no single correct way to do things. You and your significant other are going to have to talk things over, figure out what is going to work best for you and go with that. If you're having a tough time coming to a consensus you can always point them to this site and tell them "Hey, when that guy isn't writing stories about farts and giggling about unintentionally phallic objects he has a few thoughts on joint bank account management you should look into." That should pretty much seal the deal that I'm a totally credible source of information.

It's a whole new experience sharing your finances with someone

f*#&ing Scrumptious

The prospect of someone else having access to all your financial information, as well as your purchasing habits once you get married can be unsettling at first. Who want's to face having to explain to their angry spouse why they bought a forty dollar box of Rice Krispies Treats Cereal on Amazon? Certainly not me. (Because they're goddamn delicious and you can't get them in stores anymore FYI)

Going from having complete and total control over how and when you spend your own money to managing everything with another person can be stressful, especially if you end up feeling like your unable to have any 'fun money' to spend on the occasional frivolous item for yourself.

If this resonates with you, perhaps the same method of managing finances that works for my wife and I will fit you and your partner. We organize our finances so that we cover some things together, whilst still maintaining a portion of our incomes independently.

The Future is now!

99% Murder Efficiency

First I'll say this. I love the continued progress we are making in the world towards not having to interact humans for basic services. When the inevitable robot apocalypse occurs and humans are overthrown as the dominant life form on the planet by the new master race of robo-murdertron 9000's and I'm hunted down and pulped to make some sort of battery recharging slurry my last words will be "At least for a while I was able to do my banking without having to talk to anyone".

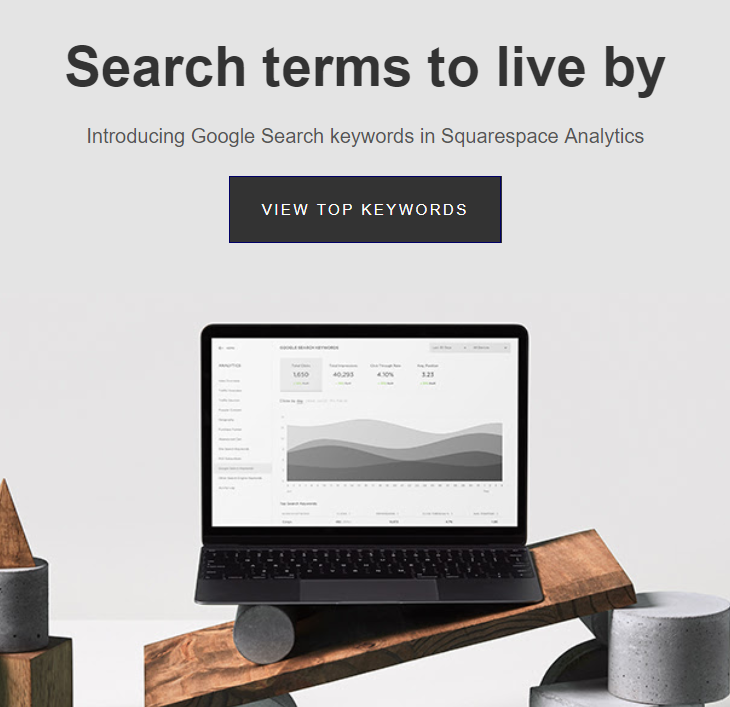

Setting up multiple accounts with your bank and managing them from your computer or phone is awesome. In our household, we've got all our accounts at our fingertips and can move money around at will. It makes maintaining multiple checking and savings accounts which we've designated for different purposes a snap.

I highly recommend if you are not already doing so, get yourself set up to do mobile banking with accounts you both have access to. It will help massively with managing your budget and keeping you both on the same page with your finances.

Getting your budget in order

Before we get to the part of managing your finances together where you get your own money to blow on headphones for your cat or something, you should make sure all of your other affairs are in order.

Headphones for your cat, not to be confused with cat headphones

In other words, the order of importance of figuring out where your money is going looks something like this:

- Bills and essentials

- Savings

- Cat Headphones

Seems simple but it's really easy to forget that you need to make sure you've got all your bills payed and you're putting something away for later before running out to buy a new gadget. Especially if you're younger and just starting out. Way too many times have I heard things like It's okay to be broke now, your just starting out, you're supposed to be broke. You've got time to save later. As justification for spending on things you really can't afford. A word of advice: It is okay to be broke, and it is okay treat yourself, but do so responsibly. Always be putting at least something away for later. Even if it's just a few bucks a month at first. Even if it just means going out to dinner one less time that month, that's twenty bucks more than you had before and it adds up over time. You may be glad you've got a few hundred or a few thousand bucks in reserve down the road in an emergency.

How We Do It

What we did for our money management was work out a system where all of our recurring bills are payed from a single joint checking account that we set up solely for that purpose. We each contribute 50% towards bills like rent, utilities, food, cable, ect, while putting in 100% of the cost towards any recurring bills we felt were individual responsibilities (things like student loans and individual car payments).

This works for us as it has all of our money going out from one account for easy tracking, and in a situation where my monthly expenses are much higher than her's due to my student loans and the fact that her car is payed off already, it doesn't put that financial burden on her. Everything is nice and even.

Once we had the bills covered we each took whatever was left from each of our monthly incomes and split it up in several ways. These boil down to: Long term savings, incidentals, and fun money.

Long term savings is money we put aside in addition to what we are each already contributing to our respective 401k and retirement funds. This is money that we don't touch, but have readily available in an emergency. (Like if one of our jerk dogs breaks through two secured gates, gets into the kitchen and eats seven ears of corn and needs emergency surgery, to provide you with a highly specific example).

Incidentals is for the various things you inevitably need to purchase that aren't covered in the monthly budget. We move a certain amount of money to this account each month and use it for the random purchases we make throughout the month (like 95% of it being the twelve consecutive trips I end up making to Lowe's every time I try to fix something stupid around the house like the outside hoses.) As we are still in the process of furnishing our house we periodically try to let it build up over a while and then make a large purchase like a piece of furniture. (We never buy anything we can't afford to pay for then and there. Credit card debt is the writhing spawn of Satan's housekeeper Norma.)

Now onto my personal favorite: Fun money. We have together fun money, and we have individual fun money. Each month after we've moved the designated amount of money for our bills, incidentals and long term savings, we take whatever is left over and put it into the fun money accounts. We have one that we share, which we use primarily to save for vacations, and we each have a separate account that the other person doesn't have access to.

go hard.

With the bills paid and some money being squirreled away for a rainy day, the money in this personal account is considered ours and ours alone to do with as we please. If I want to buy a 40 dollar box of cereal on the internet, I can do so entirely guilt free. She loves getting her nails done, if she wants to go do that, great! If I purchase a sick cat sweater, we have a talk about being embarrasing in public but hell if that's not my money to spend on cat sweaters if I want! Having that little bit of money set aside each month that is entirely yours to spend on whatever you want is, in my opinion, a healthy way to maintain that balance between "his and her" money and "our" money.

The other benefit to managing things this way is that it forces you to be more responsible and deliberate with your purchasing. If I want to blow all my money on Cat sweaters and Cereal, I'm free to do that, but I only put so much money in my fun money account each month. If I spend it all, there is no dipping into the other pools of cash, I've gotta wait. If I want to buy something more expensive, I've got to be happy with the sweaters I already own, and whatever bran flavored box of disappointing adult cereal we have in the house for a couple of months. Ultimately I find it makes purchasing that new laptop or expensive gadget all the more rewarding because the anticipation of saving up for it made it that much more sweet when I actually got my hands on it.

Bottom Line, have boundaries set and stick to them

Now before you run off and buy a purebred Welsh Corgi which is genetically proven to be a 99% genetic relative to the Queen of England's third favorite dog and name him Colonel Stuben Crumplebuttons, or roll out to the gentleman's club and make it rain singles on a dancer named Cinnamon who's "just working her way through nursing school", realize that while fun money is meant to be for you to spend on things that make you happy, you are still in a relationship.

Don't go pointing the finger at me when your significant other is pissed that you got a dog without consulting them or come home smelling like glitter and broken dreams. "The cat sweater and cereal guy said I could spend this money on whatever I wanted!" is not going to fly, I promise you that.

Make sure if you are purchasing something that will affect the other person, you consult with them before doing it.

Like in all things in a marriage, you can usually avoid conflict by talking things out with one another and being on the same page with your plan. That goes not just for how you are spending your fun money, but for setting up your budget and establishing how any leftover money is being handled after the bills have been payed in the first place.

As I said before, the plan I outlined is just how my wife and I handle things. That's what works for us, but it might not be what is best for you. Figure out your plan for your finances and once it's in place, stick to it. Before you know it you'll be rolling in all the cat sweaters and cereal you could ever want.